Classic Car Road Tax

A vehicle is classed as a vintageveteran once its 30 years old from date of manufacture and a concessionary rate of motor tax applies See List of Motor Tax Rates. How to Change Classic Car To Historic TAX 40 Years FREE ROAD TAXSo my car has finally turned 40 years old and is now eligible for Vehicle Road Tax excepti.

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

From April 2014 the classic car exemption from VED will begin rolling from 40 years with cars built before January 1974 eligible for a zero-rated tax disc.

. By Luke Chillingsworth 0401 Sun Dec 26 2021 UPDATED. Guideline in Applying for Commercial Vehicle Modification Previous HID Headlamps Enforcement Next Corporate Info On April 1 1946 the Road Transport Department was set up to coordinate all aspects of transportation across the state. Vehicles registered before March 1 2001 will have Vehicle Excise Duty VEDcharged as determined by engine size.

Then from January 2015 the formerly fixed cut-off will become a rolling one. Published 19 March 2014. There is not a higher tax rate for larger engine sizes but there is.

The half-year payment is 555 of the annual rate. The state follows the OBD-II-era 1996-or-newer-only requirement for emissions testing which is great for most classic vehicle owners. Vehicle tax exemptions and MOT exemptions for vehicles built or first registered.

Currently I have 6 cars registered under my name and i intends to apply for my mercedes E200 W124 year model is 1995 please advise thank you. MOT and vehicle tax Skip to contents of guide. But thats not even definitive as far as classic cars go because some cars built after 1977 are classics.

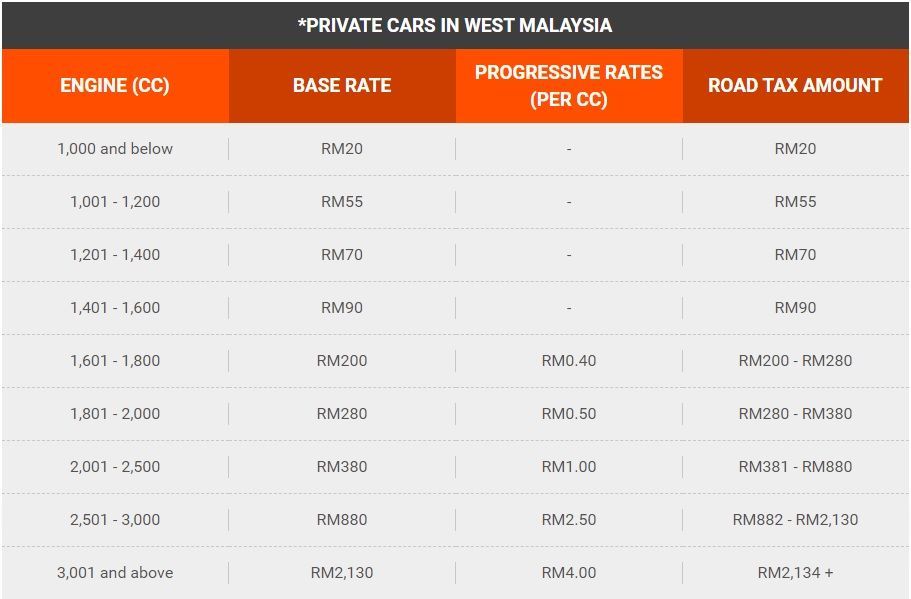

Hope that all helps understand the Irish motor tax system but if you have any specific questions weve not covered feel free to drop us a question via the Ask Us Anything page. If your car have high CC like corvette or aston martin its good to get classic road tax or else youll be paying more than RM8000 for road tax. You can apply to stop paying for vehicle tax from 1 April 2021 if your vehicle was built before 1 January 1981.

Classic bikers pay just 26. If the vehicle owner does not have the appropriate registration. Changing the taxation class on any vehicle eligible for Vintage classification requires a declaration on application form RF111 change of particulars httpswwwmotortax.

It costs 220 to tax a car with a 1600 litre engine car for a year or 121 for 6 months. Taxation Classes And Costs. Befitting its antic status.

You can pay the tax at on the motor tax website. This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying road tax. The car must have a high value.

Vehicles are exempt from paying vehicle tax if they are 40 years old or older on January 1 2017. Tax exemption for classic cars is now rolling. Sales tax is steep at 7 percent but theres no annual excise tax.

I not actually check but based on the discount should be car with higher cc the more discount given but i heard need to get endorsed by vintage or classic car club. Cars with an engine smaller than 1549cc will pay 145 each year while those will engine sizes over this will pay 230. Before that date cars pay tax based on the size of the engine.

CLASSIC car owners could be penalised a lot more than other road users in the event of new pay per mile car tax changes. Classic Vehicle Road Tax Explained. Historic vehicle tax exemption.

This means that from 1 April each year vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from paying Vehicle Excise Duty VED otherwise known as road tax. This is because owners of classic cars are likely to use their vehicles a. The car must be in mint condition not rusted with gleaming and spotless paintjob and chrome.

Appropriate fee -See List of Motor Tax Rates. Desmond John Haines says. This principle covers vehicles built or registered in 1977.

Good Day Sirs I would like to joint classic club and apply for classic car road tax. While the definition of what makes a car a classic can vary the status of a classic car in terms of tax exemption is much more specific. No NCTCRW required for Vintage Vehicles.

Tax exemptions for classic cars are rolling based on a 40-year scale. He said vehicles under 40-years-old which currently pay road tax would save under a pay per mile scheme. The quarterly payment is 2825 of the annual rate.

Classic car owners pay just 55 a year but the car in question must be at least 30 years old. Theres good news for classic car owners in the 2014 budget. Any vehicle body type 30 years old from date of manufacture qualifies as vintage on which a concessionary rate of motor tax can apply.

Greg Giacchi owns a Datsun 280Z a second-generation Supra and a second-gen Trans Am and says No complaints here in New Jersey. The monthly cost is 10 of the annual rate. Or simply put in showroom condition.

Vintageclassic cars that were brought from another country only qualify after having been registered in Malaysia for 2 years.

Car Tax Disc Changes Five Facts You Never Knew About Your Almost Obsolete Tax Disc The Independent The Independent

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Comments

Post a Comment